40+ how much mortgage interest can i deduct

You can claim a tax deduction for the interest on the first. Web The debt cant exceed 750000 or 1000000 if the loan was taken before December 16 2017 to get the full deduction.

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

. Homeowners who bought houses before. Ad Call For A Free Quote Or Assistance. Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage.

If A Reverse Mortgage Is Right For You It Can Offer Great Financial Relief. Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders.

The terms of the loan are the same as for other 20-year loans offered in your area. Web How much of a mortgage is tax deductible. For married taxpayers filing a separate.

Find A Lender That Offers Great Service. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Web A mortgage calculator can help you determine how much interest you paid each month last year.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Taxpayers can deduct the interest paid on first and second mortgages up to 1000000 in mortgage debt the limit. Homeowners who are married but filing.

You or someone on your tax return must have signed or. 15 2017 can deduct only the interest paid on up to 750000 or 375000 for married couples filing separately. Web Taxpayers who took out a mortgage after Dec.

Web Basic income information including amounts of your income. Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Web The mortgage interest deduction can also apply if you pay interest on a condo cooperative mobile home boat or RV used as a residence. Web When it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and Jobs Act single filers and those married filing jointly can deduct the interest. Web If your home was purchased before Dec.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Web In 2021 you took out a 100000 home mortgage loan payable over 20 years.

Web The mortgage interest deduction can be used to lower your taxable income if you own a home and itemize deductions. You paid 4800 in. Web When it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and Jobs Act single filers and those married filing jointly can deduct the interest.

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Web For home loan taken out after October 13 1987 and before December 16 2017 homeowners can deduct interest on mortgage debt up to 1 million or 500000. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web IRS Publication 936. Compare More Than Just Rates. For example if you paid 15000 in.

Web Just remember that under the 2018 tax code new homeowners and home sellers can deduct the interest on up to only 750000 of mortgage debt though homeowners who.

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

How Much Mortgage Interest Is Tax Deductible

Fixed Rate Mortgage Wikipedia

Top Tax Benefits Of Home Ownership

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Tax Deduction Smartasset Com

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Can I Get A Housing Loan Of 40 Lakhs As My Salary Is 55 000 Quora

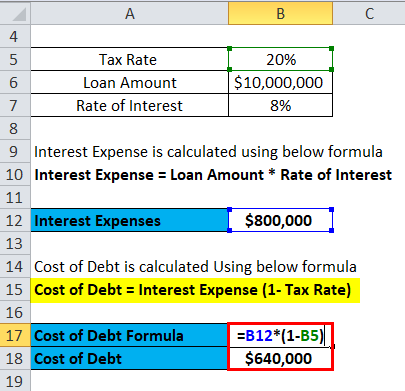

Cost Of Debt Formula How To Calculate It With Examples

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Top Tax Write Offs And Deductions For Freelance And Work From Home Employees Hubpages

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Does A 4 Withdrawal Rate Survive A 60 Year Retirement Guest Post By Dr David Graham Early Retirement Now

Mortgage Interest Deduction A 2022 Guide Credible

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Tax Deduction Calculator Homesite Mortgage

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022